Welcome

Professional Mortgage Services

Get the guidance you need! Our team specializes in:

- HELOC

- Low Credit Score FHA

- Bankruptcy

- Self Employment, 1099

- Bank Statement

- DSCR

Forever Home Financing Blog

How to Understand a Loan Estimate on FHA and VA Home Loans

May 22, 2025

If you’re applying for a mortgage, whether it’s through the Federal Housing Administration (FHA) or a VA loan backed by...

FHA One-Time Close Ground-Up Construction Loans: Your Guide to Building a Home from the Ground Up

May 9, 2025

Building your dream home from scratch is an exciting endeavor, and with the right financing, it can be a seamless...

Mortgage Pre-Approval vs. Pre-Qualification: Understanding the Differences and Which Is More Beneficial

April 16, 2025

Buying a home is one of the most significant financial decisions most people will make in their lifetime. It’s a...

Down Payment Assistance Programs: Looking for programs that can help reduce the upfront cost of purchasing a home

April 16, 2025

Purchasing a home is a significant milestone, but the substantial upfront costs, particularly the down payment, can be a barrier...

The Ultimate Guide to Getting an FHA Loan as a First-Time Home Buyer in the Summer of 2025

April 2, 2025

Purchasing your first home is an exciting milestone, but it can also feel overwhelming—especially when it comes to navigating the...

Getting a Home Loan with a Low Down Payment Immediately After Foreclosure: A Guide to Your Path to Homeownership

April 2, 2025

If you’ve recently experienced a foreclosure, the road to homeownership might seem daunting. One of the biggest challenges you may...

How to Get a Home Loan Without Using Taxes in 2025

March 26, 2025

In 2025, the landscape of home loans continues to evolve. With rising property prices and changing lending regulations, prospective homeowners...

How to Get an FHA Loan as a First-Time Homebuyer in 2025

March 20, 2025

For many first-time homebuyers, securing a mortgage can feel like an overwhelming task. With the variety of loan options available,...

How to Get a HELOC Using Bank Statements in 2025: A Step-by-Step Guide

March 17, 2025

In recent years, homeowners have found themselves exploring various ways to access the equity in their homes. One popular financial...

The Ultimate Guide to Investing in Property Near Orlando Theme Parks: Your Gateway to Profits

March 5, 2025

Orlando, Florida, is more than just the home of world-famous theme parks like Walt Disney World, Universal Studios, and SeaWorld....

How to Get a Home Without Using Your Tax Returns or W-2s in the 2025 Spring Housing Market

March 4, 2025

The 2025 spring housing market is expected to be a dynamic and competitive time for prospective homebuyers. Many buyers are...

How to Get a Home Loan 1 Day After a Chapter 7 Bankruptcy with a Low 600 Credit Score

March 3, 2025

Filing for Chapter 7 bankruptcy can feel like a major setback, especially for those dreaming of homeownership. But here’s the...

How to Secure a Home Loan Without Using Your Taxes: A Guide to Alternative Financing Options

February 24, 2025

Purchasing a home is a major life decision, and for many, securing a home loan is an essential part of...

Getting a Down Payment Assistance Loan in 2025 During the Spring Market: A Comprehensive Guide

February 21, 2025

The spring housing market is one of the most competitive and fast-moving times of the year, with many buyers looking to take...

Getting a Loan Immediately After a Chapter 7 Bankruptcy: What You Need to Know

February 10, 2025

Filing for bankruptcy can be a stressful and overwhelming experience. A Chapter 7 bankruptcy, in particular, involves liquidating your assets...

Using a Mortgage Broker to Get Commercial Financing in 2025

February 10, 2025

When it comes to securing commercial financing, business owners and investors often face a daunting task. With a myriad of...

How to Buy a Home with Bitcoin in 2025: A Complete Guide

February 3, 2025

In recent years, cryptocurrency, particularly Bitcoin, has emerged as a powerful financial tool. From its humble beginnings in 2009 to becoming...

Getting a Home Loan in Miami with an ITIN Number

February 3, 2025

Purchasing a home is a dream for many people, but the process can seem daunting, especially for those who don’t...

The Ultimate Guide to Buying Your First Home: Steps, Tips, and Resources

January 30, 2025

Purchasing your first home is an exciting milestone, but it can also feel overwhelming. With so many moving parts—from securing...

The Ultimate Guide to Getting a Jumbo Loan in 2025

January 29, 2025

When it comes to securing a mortgage for a home purchase, many buyers are familiar with conventional loans, FHA loans,...

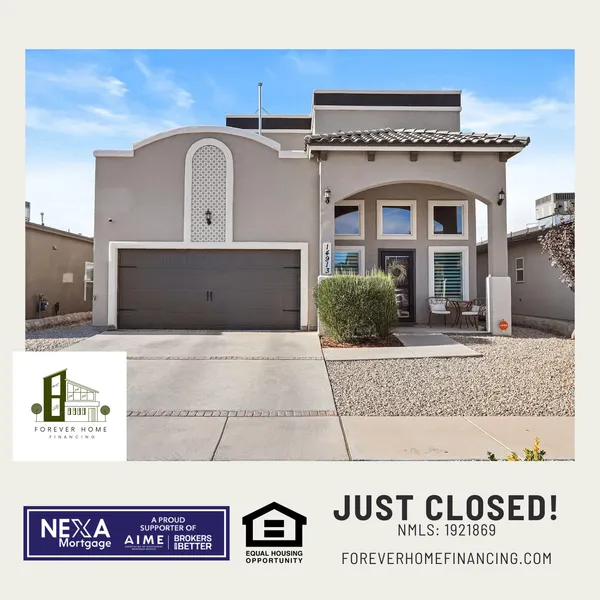

Recent Closing

Forever Home Financing, Powered by NEXA Mortgage, LLC

Individual NMLS #: 2162767

Individual NMLS #: 1921869

Corporate NMLS #: 1660690

NEXA Mortgage LLC, Company Sate License: #AZMB- 0944059

NEXA Mortgage LLC Corporate Address: 3100 W Ray Rd. STE 201 Office #209 Chandler, AZ 85226

NMLS Consumer Access Link click here

Contact Us

Contact Information

Phone – (815) 582-9066

Email – admin@foreverhomefinancing.com

Working Hours

Available 7 Days A Week

Monday – Sunday: 8am – 9pm